State of AI Apps Report 2025 is Live!

Digital Advertising Insights · Mobile App Insights · Ben Laskey · March 2023

How ESPN Capitalizes on March Madness Fever

The biggest basketball tournament of the year is here and ESPN (and their app) is at the Big Dance too. What the data tells us and what you should know.

March Madness is here and millions of viewers will be tuning into this year's NCAA Basketball tournament to cheer on their favorite team, or live out the heartbreak of an upset. And while many die-hard fans will be glued to their monitors, this tourney offers non-sports addicts the opportunity to flex their luck by participating in bracket pools with their friends and colleagues.

Capitalizing on the tournament hoopla (gratuitous basketball pun), ESPN has spent heavily on advertising their Tournament Challenge App to increase daily active users and session times, resulting in an opportunity to use their app as a channel to generate revenue through in-app purchases, advertising space, and subscriptions. So what have we learned about their approach in the build-up to the tournament?

How has ESPN promoted their Tournament Challenge App?

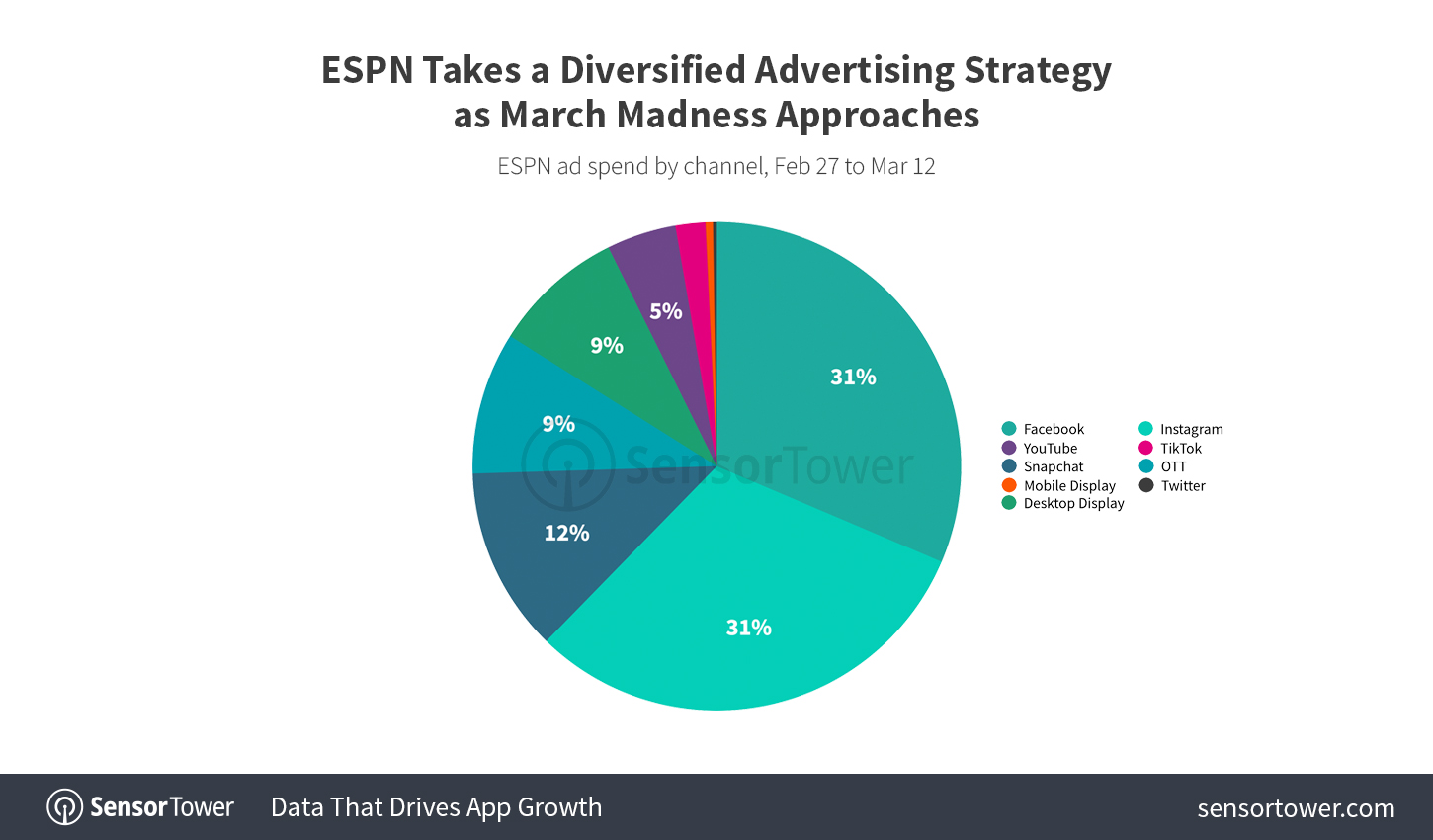

ESPN has taken a diverse approach to advertising their Tournament Challenge app in the United States compared to some of their competitors in the marketplace like Yahoo Sports. When we dig into the data on Sensor Tower, we find ESPN allocated 62% of their ad spend to Instagram & Facebook since February 27th, while also spending roughly 20% of their budget across emerging channels like OTT & Snapchat. It’s pretty clear ESPN has been targeting their ads toward different demographics based on their channel strategy, while competitive apps like Yahoo Sports Fantasy & Daily and CBS Sports have opted for a more traditional approach, allocating 72% and 62%, of their ad dollars towards Mobile & Desktop Display Ads in the same time frame.

So they’ve spent big, what are the results?

As a result of their advertising strategy, ESPN Tournament Challenge has become the No. 1 most downloaded free sports app in the App Store with roughly 394,000 downloads since February 27th – more than double NCAA’s March Madness live app (According to data gathered using Sensor Tower Store Intelligence).

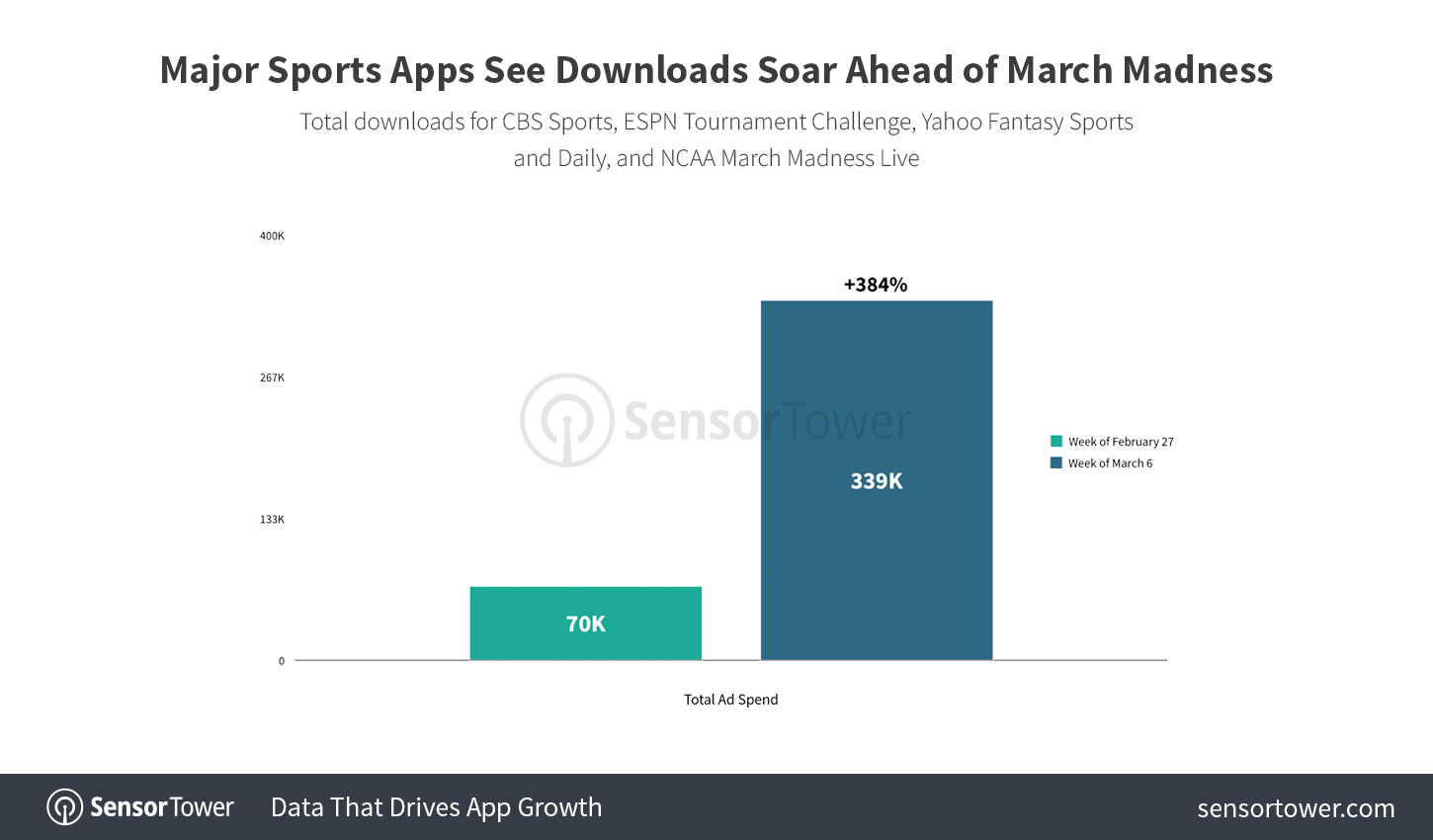

So how did ESPN realize 947% week over week download growth since February 27th, when the top 4 march madness apps only saw 384%?

For one, ESPN has spent far more on advertising, with total ad spend reaching over $5 million since the week of February 27th. Not only did they allocate a heavy portion of their ad dollars to promoting their app, but they were strategic in where they spent. If Yahoo or CBS allocated more than 4% of their ad spend to Snapchat & OTT, would they have been able to capitalize on March Madness to the extent ESPN did?

Another reason ESPN is poised for tournament success is their ability to drive new users to a separate app which allowed them to create a niche audience to advertise. By understanding the demographic using their app, they’re able to serve more ads and generate a higher number of in-app purchases, turning a fun prediction app into a revenue generating machine.

So what does this mean for you? When looking to capitalize on seasonal trends or a landmark event, data shows that channel strategy is a key factor in driving new users to your app, and in turn, increasing revenue from ad dollars and in-app purchases.

Want to learn more about how the biggest brands are advertising on digital? Or how you can turn your app into a revenue generating machine? Speak with an expert today!